Curious About Finding Out About Home Mortgages? Read This

Article written by-McElroy PappasGetting a great deal on your home mortgages is not easy. Paying it off in a timely manner also takes quite a bit of work. Doing your research before you sign the mortgage papers is your best bet. Follow the helpful home mortgage tips listed below to make sure you have the upper hand when signing the papers for a home mortgage.

Consider unexpected expenses when you decide on the monthly mortgage payment that you can afford. It is not always a good idea to borrow the maximum that the lender will allow if your payment will stretch your budget to the limit and unexpected bills would leave you unable to make your payment.

Don't make any sudden moves with your credit during your mortgage process. If your mortgage is approved, your credit needs to stay put until closing. After a lender pulls up your credit and says you're approved, that doesn't mean it's a done deal. Many lenders will pull your credit again just before the loan closes. Avoid doing https://www.prnewswire.com/news-releases/defi-technologies-announces-closing-of-chf-25-million-investment-in-seba-bank-ag-a-swiss-global-digital-assets-bank-301467521.html that could impact your credit. Don't close accounts or apply for new credit lines. Be sure to pay your bills on time and don't finance new cars.

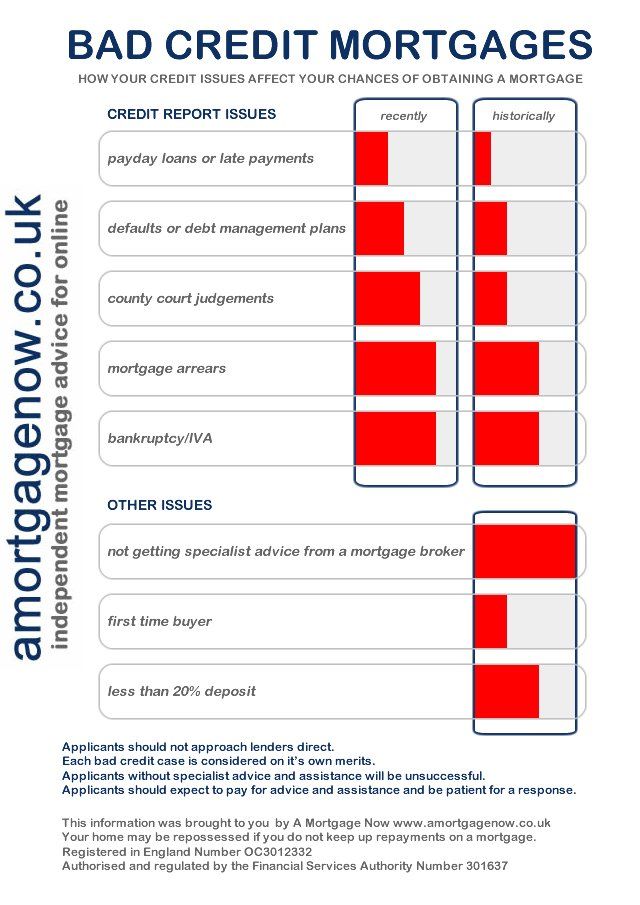

Before applying for a mortgage loan, check your credit score and credit history. Any lender you visit will do this, and by checking on your credit before applying you can see the same information they will see. You can then take the time to clean up any credit problems that might keep you from getting a loan.

Although using money given to you as a gift from relatives for your downpayment is legal, make sue to document that the money is a gift. The lending institution may require a written statement from the donor and documentation about when the deposit to your bank account was made. Have this documentation ready for your lender.

Hire an attorney to help you understand your mortgage terms. Even those with degrees in accounting can find it difficult to fully understand the terms of a mortgage loan, and just trusting someone's word on what everything means can cause you problems down the line. Get an attorney to look it over and make everything clear.

Be sure to keep all payments current when you are in the process of getting a mortgage loan. If you are in the middle of the loan approval process and there is some indication that you have been delinquent with any payments, it may affect your loan status in a negative way.

There are several good government programs designed to assist first time homebuyers. Many programs help you reduce your costs and fees.

Know what your other fees will be, as well as your mortgage fees, before you sign a formal agreement. There will be closing costs, which should be itemized, and other miscellaneous charges and commission fees. You can negotiate some of these terms with your lender or seller.

Because the mortgage industry is not regulated, get your loan from a reputable company. Avoid working with a mortgage company that is only available to you online. It is important to choose a company that is known to you and who will be available to you. Do not use the services of a mortgage broker who records your income or expenses inaccurately.

Ask your friends if they have any tips regarding mortgages. https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/why-now-is-a-good-time-to-own-european-bank-stocks-66100747 might have some helpful advice for you. Some might have had bad experiences, and you can avoid that with the information they share with you. If you discuss your situation with a number of different people,you will learn a lot.

Answer every question on your home mortgage application absolutely honestly. There is no benefit in lying, as all of the information that you provide will be thoroughly examined for accuracy. Additionally, a small fib could easily lead to your denial, so just be honest from the start so that you have the best chances.

Remember that there are always closing costs and a down payment associated with a home mortgage. Closing costs could be about three or four percent of the price of the home you select. Be sure to establish a savings account and fund it well so that you will be able to cover your down payment and closing costs comfortably.

Avoid mortgages with an interest rate that is variable. The interest rate on these types of loans can increase drastically, depending on how the economy changes, which can result in your mortgage doubling. An extremely high interest rate could make it impossible for you to afford your monthly payments.

Many lenders now require a home to be inspected before the loan is approved. Although this costs a small amount of money, it can save you thousands in unknown expenses. If the home inspector finds problems with the home, you have the opportunity to either negate the contract or to renegotiate the sales price.

Before refinancing to get a little extra cash, make sure that the mortgage loan you are taking out isn't costing you more than the cash you are getting. Often times that's the case. The money you get is totally offset by the fees and closing costs associated with the refinance.

Do not charge up your credit cards or open new accounts if you have been approved for a mortgage. Many lenders get an additional credit report on the borrower a couple of days before closing on the loan. Your credit score can be hurt by maxed-out credit cards or new lines of credit. This can lead to your loan being denied at the last minute.

If you're going to look on the internet for a home mortgage loan, make sure that the company you're applying with is legitimate. Scams in home mortgages aren't on the level of the Nigerian Prince scheme, but you will still run across some crooked lenders. Make sure they're legitimate before applying.

Loans are a risk, and when it comes to a mortgage, they're even more so. Finding the right loan is essential. What you've just read will help you get the best deal on a mortgage that you can.